The ESG wave is cresting, and as it does, companies are being caught in various positions ranging from surfing it to being caught in the break. For those not yet riding the wave, there can be a lot of consternation that can ripple from the boardroom to the field. For Environmental Health and Safety Managers, this presents both risks and opportunity.

The risks include being caught unaware by data requests, facing unrealistic expectations, or facing shifting benchmarks as companies try to navigate what are often uncharted waters. These uncertainties also provide opportunities, as understanding the currents and trends can give EHS managers the context to not only respond to requests more effectively, but also to help navigate.

In general, the role of the EHS professional in ESG reporting is to provide data that best aligns with the standards a given company is using to report on their sustainability journey. Further, since ESG standards are by their nature comprehensive in covering Environmental, Social and Governance data, the primary concern for EHS professionals tend to be the E and a portion of the S (the safety part). Understanding what is critical information versus good-to-have and how the process can evolve over time will help empower you to do your job most effectively.

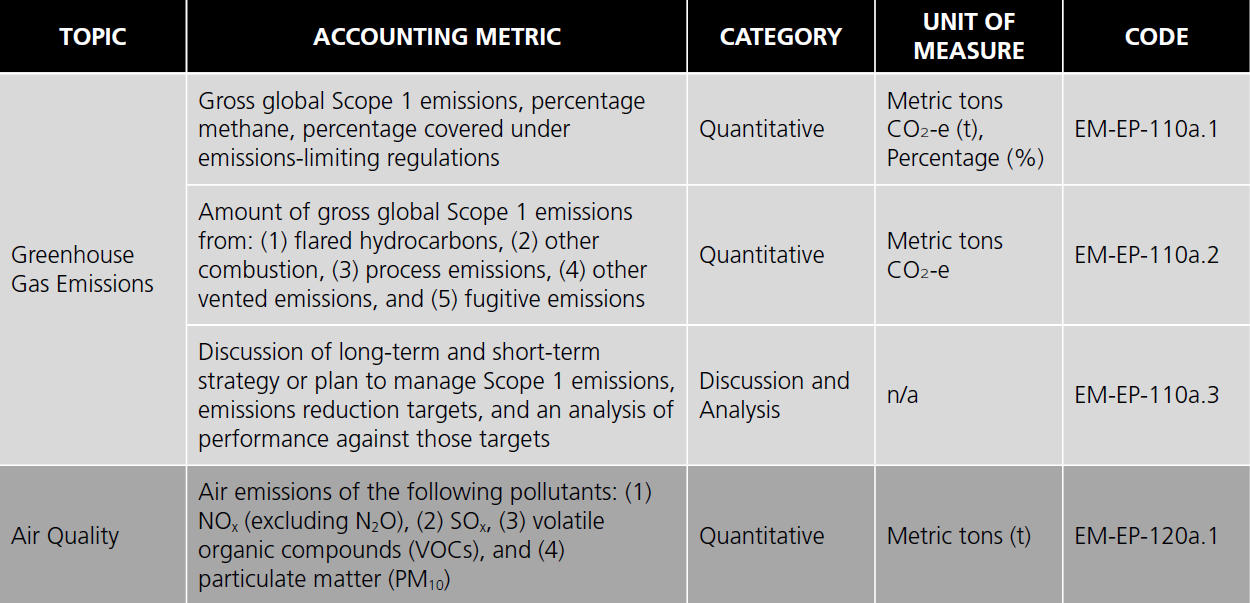

While there is no single standard to follow, there are some standards that are ubiquitous enough that familiarity is warranted. The first of these is SASB, the Sustainability Accounting Standards Board. SASB standards are industry specific, and were developed specifically to be the minimum amount of disclosure topics needed that would be material for investors to be able to compare and make reasonable investment decisions. They can be considered the baseline for sustainability or ESG (or Corporate Social Responsibility, a term still in use that is analogous) reporting, are publicly available here, and are relatively user-friendly to determine which standards to use.

Look for the disclosure topic tables in your industry to get straight to the heart of what you will need to know.