RECs are considered best practice to offset scope 2 emissions from purchased energy (typically electricity, but can also include steam, heat, or cooling). They are purchased on a 1:1 basis for electricity consumption in MWh, so 1 REC = 1 MWh. One critical aspect of RECs is that they do not consider the carbon intensity of the electricity used, so regardless of how many renewable sources a particular utility uses to generate electricity, 1 REC funds and provides the generation of 1 MWh of carbon-free electricity. Therefore, RECs can offset more carbon than they generate, resulting in a net carbon reduction greater than 1 MWh. Since Spirit still calculates this value for the corporate carbon footprint, we know that our blended carbon intensity is approximately 0.78 metric tons of CO2 emitted/MWh, and approximately 26% of grid electricity from non-carbon sources. The purchased RECs were a blend of wind and solar generation.

Additional attributes of carbon offsets beyond carbon mitigation range across the spectrum of Environmental, Social, and Governance (ESG) impacts. In the case of the landfill gas capture project, economic benefits in the form of new technology installation and maintenance in somewhat remote locations are provided for the local economy. In the case of biochar, the project supports Finland farmers economically, provides soil fertility benefits to increase food production with less chemical inputs, and supports a minority-led business. Purchasing carbon injected concrete credits supports the pioneering of innovative carbon removal technology and incentivizes historically risk-averse concrete producers to retrofit existing concrete plants.

While avoidance carbon offsets accounts for the quantity of carbon that would have been emitted under an alternative baseline scenario (in this case, a landfill with no methane capture system), a removal credit actually focuses on sequestering existing carbon from the atmosphere or other source. The carbon injected concrete credits fund a technology that can be retrofitted into concrete batching plants to sequester atmospheric carbon dioxide into the concrete. The carbon dioxide then undergoes mineralization so that even when the concrete is ground up, carbon dioxide remains embedded. The biochar process uses a high temperature, low oxygen process to sequester carbon from biomass and create an end product that increases soil fertility while trapping the carbon in its molecular structure. Typically, carbon removal projects are significantly more expensive on a per ton basis, so the credits follow that pricing.

An additional facet of carbon credits is the durability of carbon storage. To illustrate this concept, consider two examples. With a reforestation, a carbon credit is given for the quantity of carbon captured from the atmosphere and stored in a tree as it grows from a sapling to a mature tree. However, carbon will be released as the tree dies and rots within the next 100 years. Contrastingly, in a project like carbon injected concrete, the carbon is locked up in the molecular structure of the concrete. Even when it is demolished or landfilled, the carbon is still retained for 1000 or more years and therefore, provides long-term storage. Seeing the clear benefits of long-term carbon storage, Spirit is inspired to support projects that embody mechanisms that keep carbon out of the atmosphere more permanently.

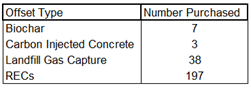

For 2021, Spirit used a blend of RECs and three types of carbon offsets to offset emissions associated with business operations, including travel as well as offsetting team member commuting. In Part 3 of Spirit’s carbon journey, this series comes up to date with our most recent 2022 offsets.