Spirit has been helping clients with their emissions in various ways since our inception. Back in 2005, most of the emissions work we supported was in permitting for Criteria Pollutants and other non-GHG emissions. As the years went by, we started supporting GHG emissions reductions and eventually helping clients offset residual GHG emissions with Carbon Credits and Renewable Energy Certificates (RECs). Our own journey has mirrored many of our clients, starting with looking at our emissions, finding ways to reduce them, and then exploring the markets for various ways to offset residual emissions.

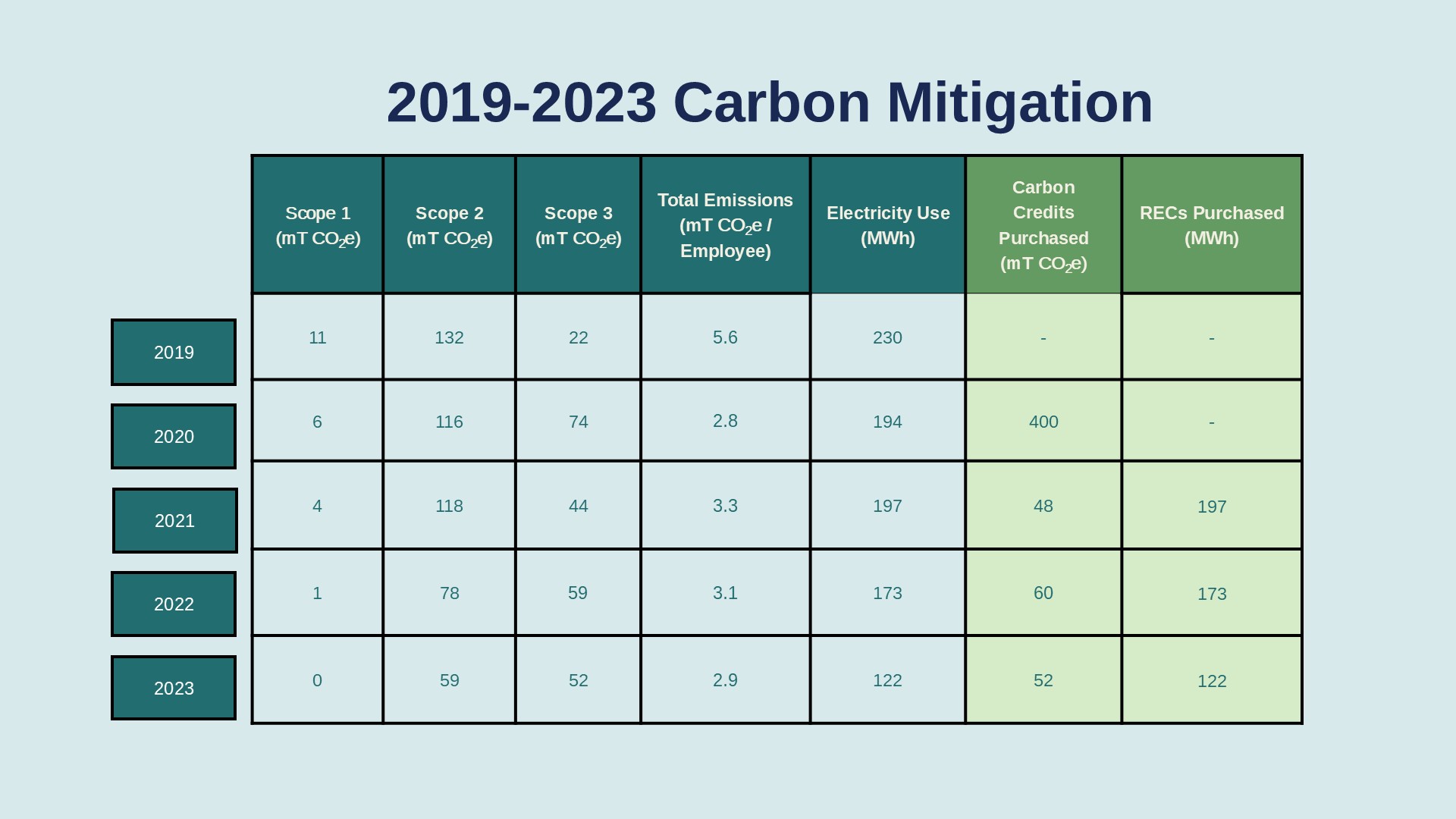

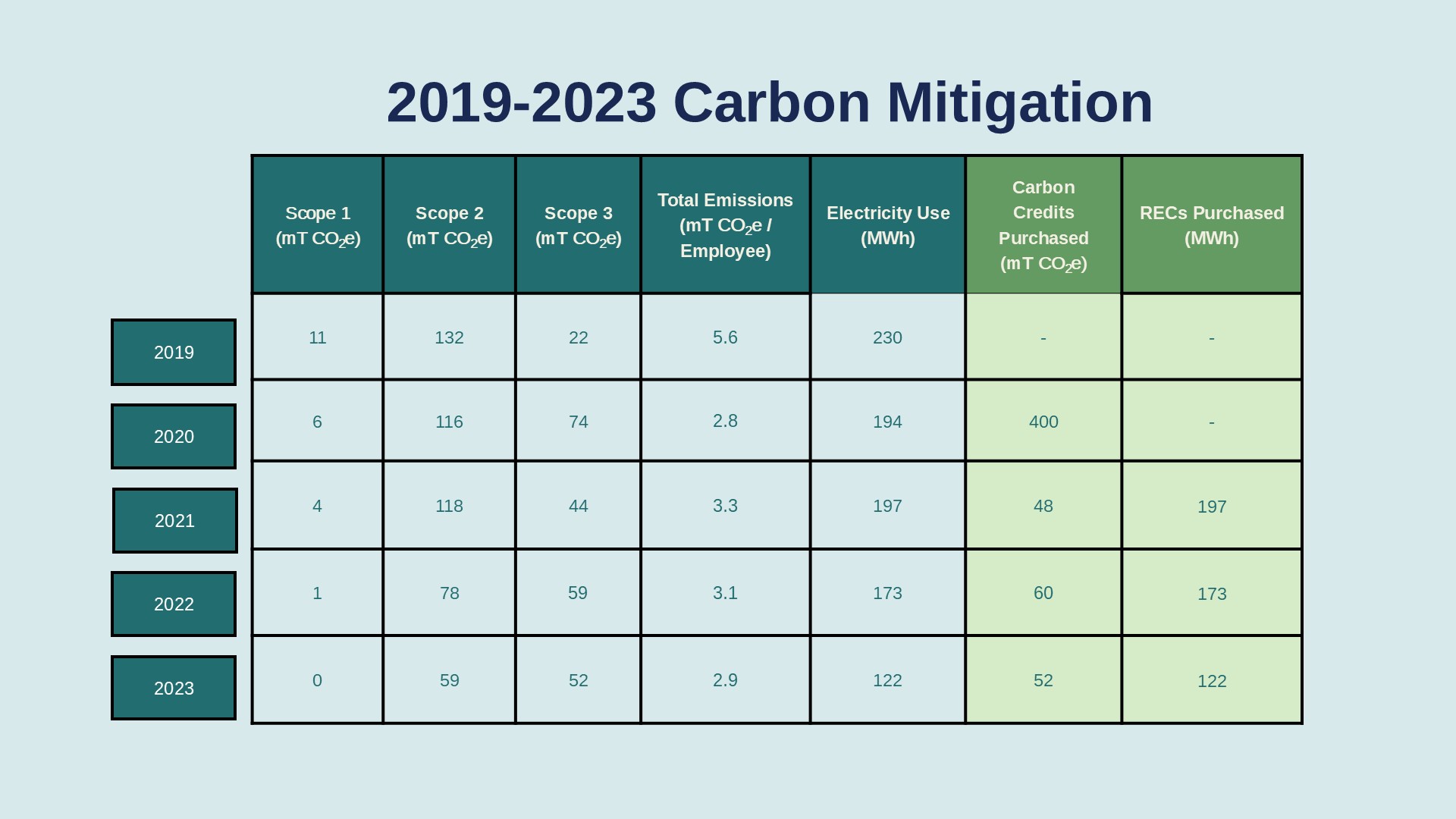

For 2019 and 2020, we offset our business-related travel emissions using carbon credits, focusing on 1:1 reductions and using landfill gas methane reduction projects whose impacts were relatable to the majority of our team. We chose not to offset our employee commuting emissions, but did offer a matching program to encourage employees to make that choice, hence some discrepancies in the table above. We over-purchased offsets for our inaugural purchase, and tried to set a tone of leadership.

We switched to RECs for Scope 2 emissions in 2021, and added commuting emissions to our mix of business travel emissions for Scope 3. in 2021 and into 2022, our portfolio of offsets shifted to include new more permanent removal credits and better aligned with team member desires to see greater co-benefits/attributes beyond carbon reductions. In 2022, in addition to the long-term carbon removal credits, we also wanted to recognize the global impact of HFC and CFC refrigerants. While banned in North America stemming from the Montreal Protocol issued in 1987, products like packaged terminal air conditioners (PTACs, commonly known as window-mounted air conditioning units) have continued to use these substances internationally that can be released to atmosphere if disposed of improperly.

In 2023, our emissions overall continued to decrease and our market sophistication continued to increase. A full year of having our Denver office in the Alliance Center, a sustainability focused building that offsets energy emissions, helped, as did the building management in Houston letting temperatures drift on the weekends and be a bit more active in energy management. Our travel for work also decreased as we continued to operate a hybrid in-office schedule and hold more remote meetings, and we officially retired our single fleet vehicle (Land and Water Truck- RIP!). We also added carbon offsets for remote working based on preliminary data from smart plugs, which will be included moving forward.

Our offset portfolio for 2023 included Wind and Solar RECs to offset Scope 2 Emissions and a combination of Green Concrete (concrete mineralization) credits (13.5%), Biochar (carbon mineralization) credits (13.5%), and Orphan Well Plugging (73%) credits.

The big addition for us in 2023 was taking advantage of a new type of credit, one that supports the plugging of orphaned oil and gas wells. These abandoned wells have no owners, and the backlog in states is such that there are not enough resources to ensure that they are adequately sealed to prevent ongoing GHG emissions to atmosphere. The creation of a protocol that enables carbon credits to be generated for private companies to plug these wells resonated as something we are professionally familiar with, has clearly defined benefits that would not be addressed otherwise, and supports our efforts to continue and address challenges with the Oil and Gas industry.

The other credits in our portfolio are both long-term removal credits that have attributes beyond carbon removal. Biochar supports soil fertility and supports small businesses, and the green concrete supports viability towards economic parity with traditional concrete which could manifest in tremendous removal and avoidance of GHGs over time.

We have continued to strive for a balance of value, impact, and innovation in our portfolio, and can proudly stand behind our purchases as meaningful and supportive of our ESG goals. As our emissions have decreased, we’ve purchased a blend of offsets that include some of the higher priced options with greater positive impacts, and remained at relatively constant pricing around $4,000 since we started offsetting. In 2023, that equated to roughly $110/employee to provide carbon neutrality that is inclusive of commuting to the office with a blend of industry relevant and complex offsets and RECs.

We at Spirit Environmental | Montrose Environmental Group remain committed to carbon neutrality and corporate leadership, supporting environmental stewardship and enhancing community sustainability wherever we can.

If you’d like more details on our journey or are curious how we might help you on yours, please reach out.

2021 is officially here and one of the early annual compliance reporting requirements is just around the corner!

The ESG wave is cresting, and as it does, companies are being caught in various positions ranging from surfing it to being caught in the break. For those not yet riding the wave, there can be a lot of consternation that can ripple from the boardroom to the field. For Environmental Health and Safety Managers, this presents both risks and opportunity.